| CEFA Universe Data Service Points as Explained by John Cole Scott |

Subscribe today to receive this valuable weekly data service covering the complete list of U.S. traded closed-end funds (CEFs). We have subscriptions available on a quarterly basis. All subscriptions come with a 14-day, no-risk trial (first-time subscribers only). During the trial period, you have the opportunity to see how beneficial the service may be before we charge your credit card.

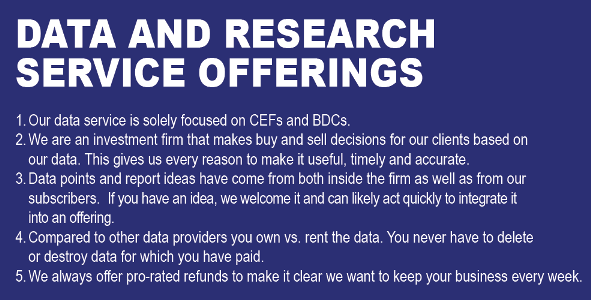

With CEFA's Closed-End Fund Universe, you can access the universe of 540+ closed-end funds and business development companies (BDCs) in the U.S.

To see the most current data covered in the service, view our CEFU Data Definitions.

- We offer the data in both PDF and XLS format. This is great for sorting and screening for closed-end funds ("CEFs") that meet specific criteria.

- We now offer a CEF and BDC Press Release Archive covering press releases for U.S.-listed closed-end funds.

- In addition, we offer overview charts on the main CEF peer groups as well as the significant subgroups covering many of the CEF universe (PDF file only).

| View a demo on how to possibly use CEF Universe data | |

| View a sample CEF Universe report (PDF format) | |

| View sample Summary Charts (PDF format) |

At CEFA, we realize that there are many data points not easily available to investment professionals or institutional/individual investors. To create this comprehensive report, CEFA monitors and reviews CEF and BDC press releases and monthly, quarterly or semi-annual fund sponsor updates.

Subscribers can access past reports of this service (beginning May 4, 2012) for viewing.

Highlights of CEFA's Closed-End Fund Universe PDF Report

| 1. | Of the 280+ data points for CEFs and 205+ for BDCs, unique key data points include: | |

| Percent Dividend is Return of Capital (Principal)* | ||

| Dividend Change Percentage* | ||

| Relative Discount* | ||

| Comparable Discount* | ||

| 1-Year Z-Stat | ||

| Date of Last Dividend Change | ||

| Earning Coverage Percentage | ||

| Capture Ratio | ||

| One-Month Net Asset Value (NAV) Trend | ||

| 90-day NAV/Market Price Correlation | ||

| Relative UNII (Undistributed Net Investment Income)* | ||

| Unrealized Capital Gains as a Percentage of NAV* | ||

| Dividend Frequency | ||

| Percentage of Leverage (40 Act and Non 40 Act) | ||

| 90-Day Average Relative Discount/Premium* | ||

| 52-Week Relative Price* | ||

| 50-Day Moving Average Relative Price* | ||

| Average Daily Trading Amount in USD* | ||

| 1-Week, Year-to-Date and 12-Month Market Total Return Performance | ||

| 1-Week, Year-to-Date and 12-Month NAV Total Return Performance | ||

| 2. | All data above included in spreadsheet (XLS format) as well as the following data: | |

| Fund Market Price | ||

| Fund Net Asset Value (NAV) | ||

| NAV Date | ||

| Relative Z-Stat | ||

| 52-Week Discount Low | ||

| 52-Week Discount High | ||

| UNII - Expressed in cents per share | ||

| 30-Day Average Trading Volume | ||

| NAV/Market Price 1-Week Dispersion | ||

| Upside Capture | ||

| Downside Capture | ||

| 3. | Accurate and detailed groupings of CEF equity funds in three main categories: | |

| U.S. Equity Funds (5 subgroups) | ||

| Non-U.S. Equity Funds (11 subgroups) | ||

| Specialty Equity Funds (10 subgroups) | ||

| 4. | Accurate and detailed groupings of CEF bond funds in three main categories: | |

| Taxable Bond Funds (17 subgroups) | ||

| Non-Taxable National Bond Funds (8 subgroups) | ||

| Non-Taxable Single State Bond Funds (26 subgroups) | ||

| Subscribe Now with a 14-day, no-risk, no payment required during trial period.** |

CEFA's Closed-End Fund Universe report is a valuable companion to the free closed-end fund resources of www.cefa.com, www.cefconnect.com and www.morningstar.com.

| * | These data points are only available through our data partner and are exclusive to our weekly service. |

| ** | Complete credit card information required by PayPal for 14-day, no-risk trial. |